Africa Builds in Motion

Before sunrise outside Nairobi, a logistics manager checks three screens: the shilling slipped overnight, a truck is delayed at Namanga, and a supermarket in Arusha still expects delivery by Friday. She reroutes through Longido, releases a mobile payment to the haulier, and files the e-manifest so customs can pre-clear. By lunchtime, the truck is moving again and the delivery window holds.

From Mombasa to Kigali, this is routine. Not chaos, choreography. Africa builds in motion, and that motion is the investment edge. Similar improvisations unfold across the continent: a cocoa exporter in Ghana coordinating with buyers via WhatsApp when Takoradi port slows, or a Nigerian fintech rerouting liquidity as the naira dips. What appears complex is, in practice, a system conditioned to adapt, turning volatility into capability, as reflected in the African Development Bank’s latest African Economic Outlook.

The Core Idea: Why Complexity Is Not a Constraint

This lived reality explains the central argument. Complexity is Africa’s advantage. Diversity, currency movement, and policy evolution have taught investors and operators to design for uncertainty rather than wait for it to disappear. The result is an investment style that rewards adaptive execution, aligned partnerships, and practical outcomes.

As global capital relearns how to price risk in an era of shocks and fragmentation, Africa’s way of investing looks less like an outlier and more like a preview of the global playbook. Progress on the continent is rarely linear. It is iterative, multilayered, and responsive, and this has shaped an investment logic that is both resilient and instructive.

That logic is visible across sectors. Kenya’s off-grid energy pioneers M-KOPA and d.light structured flexible consumer finance for households without credit histories. Rwanda modernised urban transport through pragmatic public–private partnerships. Nigerian fintechs such as Flutterwave and Paystack scaled by designing around fragmented banking systems and evolving regulation. These are not isolated success stories, but expressions of a broader investment logic built for movement.

Capital in Motion: From Volume to Alignment

If complexity shapes how investment works, it also shapes where capital comes from and how it behaves. Investment into Africa is broadening in both source and structure. Multilateral institutions and global investors remain central, but African-led capital is steadily shifting the centre of gravity.

As noted in the OECD’s Africa Capital Markets Report 2025, pension funds and insurers in South Africa, Botswana, Namibia, and Kenya are expanding mandates into infrastructure, private credit, and renewables. Sovereign funds are increasingly co-originating deals with local banks, as seen in Nigeria’s Sovereign Investment Authority’s investments in transport and healthcare. The result is capital that is closer to operating reality and more attuned to long-term performance.

Alongside this, diaspora capital plays a stabilising role. Often overlooked, remittance flows are patient and counter-cyclical. In Ethiopia and Somalia, they have underpinned microfinance ecosystems. As highlighted in the World Bank’s Migration and Development Brief, in Ghana, diaspora bonds have channelled funding into housing and energy. Gulf partners are deepening exposure in logistics and energy, while Asian partnerships continue to support manufacturing and transport.

Taken together, these shifts mark a move away from headline volumes toward alignment of term, risk-sharing, and governance. Term sheets increasingly reflect operating reality, covenants map to actual cashflows, and local institutions participate from origination rather than entry. These capital dynamics do not exist in isolation. They are being accelerated by a set of structural forces that are reshaping how and where investment becomes viable.

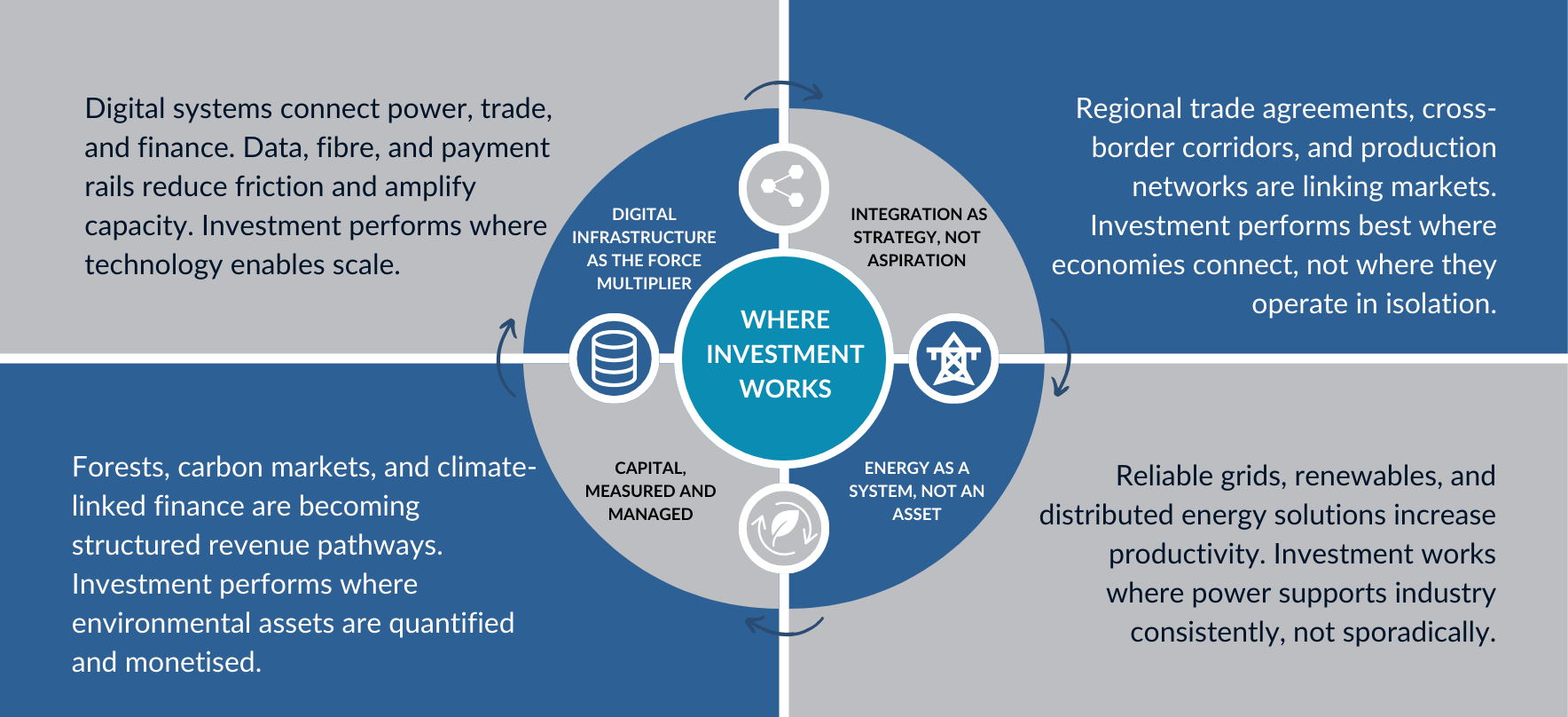

Four Forces Reshaping Where Investment Works

Manufacturing, Value Addition, and Scale

Africa is experiencing a quiet industrial renaissance. Special economic zones and industrial parks, from Ethiopia’s Hawassa Industrial Park to Nigeria’s Lekki Free Zone and Ghana’s Tema Free Zone, as analysed in recent Africa Legal Network research on Special Economic Zones, demonstrate how policy coordination, reliable power, and efficient logistics attract serious investors.

Progress has not been uniform. Some developments have stalled or moved unevenly, reflecting broader macro and execution constraints. Yet under the AfCFTA, these zones are beginning to link into regional production networks, with components produced in one country and assembled in another, as discussed in the OECD’s analysis of Africa’s next-generation Special Economic Zones. Real value is captured laterally, through integration, rather than vertically through protection. As industrial activity scales and balance sheets deepen, the central question investors confront is no longer opportunity, but how risk is understood and managed.

Risk Reframed as Operating Experience

Africa’s risk is often narrated as deficit, governance gaps, currency depreciation, and debt pressures. A more accurate description is experience. Operating through cycles has taught investors to build currency strategy from day one: matching revenues and liabilities, using natural hedges, and reserving hard currency for debt service where cashflows allow.

This approach is visible in the KenGen–Ormat geothermal partnership in Kenya, which earns USD-indexed revenues, and in MTN Nigeria’s reinvestment of local earnings to reduce currency mismatch, a strategy reported by Capital Markets in Africa. Policy risk, meanwhile, is addressed through alignment rather than hope: transparent procurement, credible tariff formulas, step-in rights, and practical dispute mechanisms. Senegal’s IPP programme and Rwanda’s PPP frameworks, examined in recent public–private partnership research on renewable energy development, illustrate how policy change becomes a managed variable rather than a project-ending shock.

Volatility does not disappear. It becomes a repeatable playbook. That conversion is the complexity dividend, faster closings, fewer operational surprises, and stronger ecosystems around each new asset. Once risk is structured this way, financial innovation follows naturally.

Financial Innovation Built for Reality

Africa’s volatility has become a testing ground for financial innovation. Kenya’s infrastructure REITs, Nigeria’s revenue-indexed bonds, and South Africa’s carbon credit platforms reflect instruments designed around real cashflows rather than theoretical stability. Partial risk guarantees and blended products from African institutions localise risk mitigation instead of importing it, as highlighted in the OECD & ACET Africa Capital Markets Report 2025.

These tools do not eliminate uncertainty. They price it intelligently, allowing capital to engage repeatedly rather than episodically. As this toolkit expands, attention increasingly turns to the institutions that make such markets credible.

Institutions and Governance as Productive Infrastructure

Institutional maturity is becoming a competitive advantage. Regulatory agencies and public finance institutions in Kenya, South Africa, Morocco, Nigeria, and Egypt are moving from formality to function, as tracked in the African Development Bank’s Development Effectiveness Review 2024. Their credibility increasingly substitutes for external guarantees.

At the same time, digital governance platforms, from e-procurement systems to digital land registries, reduce friction, increase transparency, and lower transaction costs, in line with the World Bank’s Digital Economy for Africa (DE4A) framework. Governance, when data-driven and enforced, functions as infrastructure in its own right. These institutional foundations determine whether investment outcomes extend beyond balance sheets into the real economy.

Inclusion as Evidence of Economic Depth

When investment flows into power, corridors, and payment systems, returns are generated alongside resilience. Renewables powering clinics and factories, corridors reducing spoilage for farmers, and payment rails lowering costs for small businesses create compounding effects across the real economy. Evidence from Ethiopia, Uganda, and Côte d’Ivoire, documented in FAO and African Development Bank country impact assessments, shows how capital reaching grassroots economic activity strengthens diversification and dampens macro vulnerability over time.

Inclusion here is not a by-product. It is evidence that capital is reaching productive depth, expanding the base on which growth and stability ultimately rest.

What the Next Decade Is Likely to Resemble

Looking ahead, regional capital markets are likely to be anchored by African pensions, insurers, and sovereign funds that buy, hold, and demand performance. Energy systems will blend scale with resilience. Natural capital will begin to integrate into fiscal frameworks. Digital infrastructure will move at the speed of commerce and public service.

Finance, in turn, will increasingly price reality, with more local-currency tools, revenue-linked contracts, and blended solutions that crowd in capital without distorting markets. These trajectories are not speculative. Early versions are already visible across the continent.

Closing Thought: Complexity as Capability

At dusk in Abidjan, a project engineer reworks a power-station schedule after a turbine part is delayed from Lomé. By midnight, a replacement is secured from Tema and grid-balancing plans are reset across three countries. By morning, the system stabilises, not because conditions were perfect, but because adaptation is embedded.

The world is moving toward Africa’s kind of economy, complex, adaptive, and collaborative. Africa has lived this reality for decades. That history is not a liability. It is capability.

Complexity is not a barrier in Africa. It is the blueprint.

Evaluating where investment works in Africa? Let’s bring clarity to complexity and build durable advantage. Reach out to me at Shaaziah.K@africaia.com

Feb 2026 Africa Development Emerging Markets Infrastructure Investment Economic Growth Sustainable Finance

Shaaziah Kolabhai